Thai social commerce trends and insights

- THE SHARPENER

- Apr 25, 2025

- 4 min read

Market Overview

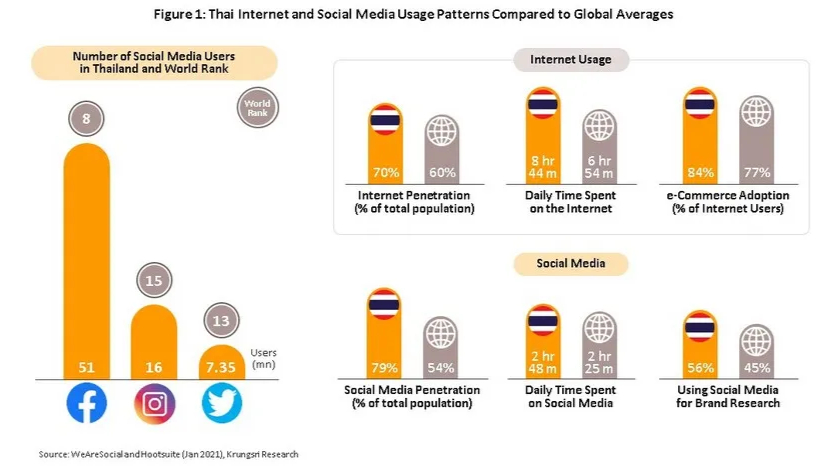

Thailand’s e-commerce sector is growing rapidly, with projected revenue of USD 16.9 billion by 2025 and a CAGR of 10.4% from 2020 to 2025. This expansion is driven by increasing smartphone use, better logistics infrastructure, and rising middle-class incomes.

Key Trends in Thailand’s E-commerce

Mobile Commerce: Mobile shopping is booming due to high smartphone penetration and social media platforms like Facebook, Instagram, and Line, which enable direct sales and engagement.

Social Commerce: Integrated shopping features and live-stream selling on social media platforms have become key sales drivers.

Payment Innovations: The adoption of digital payments, including e-wallets like TrueMoney and PromptPay, has accelerated due to government initiatives and the COVID-19 pandemic.

Logistics and Delivery Enhancements: Companies such as Kerry Express and Flash Express are improving delivery networks, offering same-day and next-day services, and enhancing last-mile delivery.

Cross-border E-commerce: Thai consumers increasingly buy international products through platforms like Lazada and Shopee, facilitated by ASEAN trade policies.

Business Opportunities in Thailand’s E-commerce Sector

Fashion and Beauty: Strong demand for trendy apparel and cosmetics, with influencer marketing driving sales.

Health and Wellness: Growing interest in supplements, organic food, and fitness products, creating opportunities for specialized offerings.

Electronics and Gadgets: High demand for smartphones, smart home devices, and gaming products, requiring strong customer support.

Online Grocery and Food Delivery: Increased preference for online grocery shopping and meal deliveries, especially post-pandemic.

Home and Living: Rising demand for home decor and furniture, with virtual consultations as an added value.

Niche Markets: Specialized products like eco-friendly goods, pet supplies, and DIY crafts offer unique market advantages.

Case study of LINE, launching Live Commerce feature in 2023

Thailand is one of the world’s leading markets for social commerce, with a significant portion of buying and selling happening through social media platforms. According to Wunderman Thompson, 80% of Thai consumers engage in social commerce, and over 60% finalize their purchases directly on these platforms, particularly on LINE.

The shift towards social commerce accelerated after the COVID-19 pandemic, as consumers sought more convenient, fast, and contactless shopping experiences. Social media has evolved beyond a communication tool into a major marketplace, offering a wide range of goods and services. Lertad “Tom” Supadhiloke, Director of e-commerce at LINE Company (Thailand) Co., Ltd., highlights that online trading in Thailand initially grew from social media platforms.

In the past, LINE SHOPPING was primarily used for retail, but today, the demand for various services has expanded. Social commerce is now more than just a retail channel, offering lifestyle services such as dog walking. This growth is driven by the social aspect of these platforms, where relationships and personal connections influence purchasing decisions.

Among the most popular products sold on LINE, fashion and clothing rank highest due to their strong connection to emotions and frequent updates. Health and beauty products come second, driven by consumer interest in personal care. The third category includes lifestyle and travel, encompassing pet-related products, hotel services, and restaurant vouchers. Hotels now promote additional services beyond accommodations, such as spa treatments. Another prominent category is mother and child products, which have gained significant traction on social media platforms, particularly LINE.

As social commerce continues to evolve, it is expected to remain a dominant force in Thailand’s digital economy, providing consumers with greater convenience and a broader range of goods and services.

The Growth and Challenges of Social Commerce in Thailand

Social commerce, particularly chat commerce, has become a crucial sales channel for SMEs in Thailand. By the end of 2019, Facebook Thailand’s managing director predicted that major new players would enter this competitive space. Before COVID-19, social commerce was expected to grow by 20–35% annually, but the pandemic accelerated its adoption.

According to LINE Thailand, 83% of Thai adults have now shopped online, with 71% using mobile phones. Additionally, 62% of online shoppers find and buy products through chat apps, reflecting Thai consumers’ preference for direct communication with sellers before purchasing. This interaction benefits sellers as well, allowing them to build strong customer relationships and influence buying decisions.

Despite this rapid growth, the future of social commerce in Thailand remains uncertain in the post-pandemic era. Krungsri Research conducted a SWOT and PESTEL analysis to assess its prospects. Social commerce has several strengths, including Thai consumers’ preference for chatting before purchasing, increased exposure for sellers, and enhanced brand loyalty. External factors such as improved logistics, strong competition, and advanced e-payment systems also contribute to its growth.

However, challenges remain. Sellers depend on social media platforms, which may change their rules unpredictably. Managing orders and responding to customer inquiries require significant effort. Additionally, concerns over payment security persist, requiring both sellers and payment service providers to address these issues effectively.

Kelvin Khant

References

Facebook Thailand (2019). Social commerce predictions.

LINE Thailand (2021). Consumer behavior in online shopping.

Krungsri Research (2021). SWOT and PESTEL analysis of social commerce

Social Commerce: The New Wave of E-commerce. Krungsri Research Intelligence 2021 Edition

Wunderman Thompson. (n.d.). Data on Thai consumer behavior in social commerce.

Supadhiloke, L. (n.d.). Insights from LINE Company (Thailand) Co., Ltd.

Exclusive interview — Lertad Supadhiloke, Director of e commerce at LINE company (Thailand) Co.,Ltd.

Dataxet Co. Infoquest Section

Earn Thongyam: Interloop, August 2024

.png)

Comments